Post Office FD Calculator 2026: Investing in fixed deposits has always been a preferred choice for risk-averse investors in India, and Post Office Fixed Deposits (FDs) remain one of the safest and most trusted options. With changing interest rates and financial planning needs, using a Post Office FD Calculator 2026 has become essential for investors who want clarity, accuracy, and better decision-making before investing their hard-earned money.

This article explains everything you need to know about the Post Office FD Calculator 2026, including how it works, applicable deposit rates, maturity calculations, and the benefits of using a calculator before investing.

What is a Post Office FD Calculator?

A Post Office FD Calculator is an online financial tool that helps investors estimate the maturity amount and interest earnings on a Post Office Fixed Deposit. Instead of manually calculating returns, this calculator provides instant results by using predefined formulas based on deposit amount, tenure, and interest rates.

In 2026, with evolving interest structures and financial awareness, the Post Office FD Calculator 2026 plays a crucial role in helping investors plan their savings efficiently. It allows users to understand how much their investment will grow over a specific period, making financial planning simpler and more transparent.

The calculator is especially useful for:

- First-time investors

- Senior citizens

- Long-term savers

- Individuals planning tax-saving investment

Mobile Deposit Rates Applied for 2026 on Post Office Fixed Deposits

For 2026, Post Office Fixed Deposit interest rates continue to be competitive and government-backed, making them highly reliable. These rates are reviewed periodically by the Government of India and may vary based on tenure.

As per the latest structure used in the Post Office FD Calculator 2026, interest rates are generally applied for the following tenures:

- 1-Year Fixed Deposit

- 2-Year Fixed Deposit

- 3-Year Fixed Deposit

- 5-Year Fixed Deposit (Tax-Saving FD)

The calculator integrates the latest mobile-accessible interest rates, ensuring that users receive updated and accurate maturity projections. Mobile accessibility also means investors can calculate returns anytime, anywhere, without visiting a post office branch.

The Post Office FD Calculator 2026 reflects these applicable rates automatically, removing confusion and reducing the risk of incorrect assumptions while investing.

also Read: क्या KSH International IPO लॉन्ग-टर्म निवेशकों के लिए स्मार्ट विकल्प है? विशेषज्ञों ने दी अपनी राय

How Does the Post Office FD Calculator Work?

The Post Office FD Calculator 2026 works using a simple interest computation mechanism based on quarterly compounding, as followed by post office fixed deposits.

To use the calculator, an investor needs to input:

- Deposit amount

- FD tenure (1, 2, 3, or 5 years)

- Applicable interest rate

Once the details are entered, the calculator instantly displays:

- Total interest earned

- Final maturity amount

The calculator uses predefined formulas approved for Post Office FDs, ensuring accuracy and reliability. It eliminates manual errors and saves time, especially when comparing multiple tenures or investment amounts.

In short, the Post Office FD Calculator 2026 converts complex financial calculations into simple, user-friendly results.

Calculation of Maturity Amounts by Post Office FD Calculator

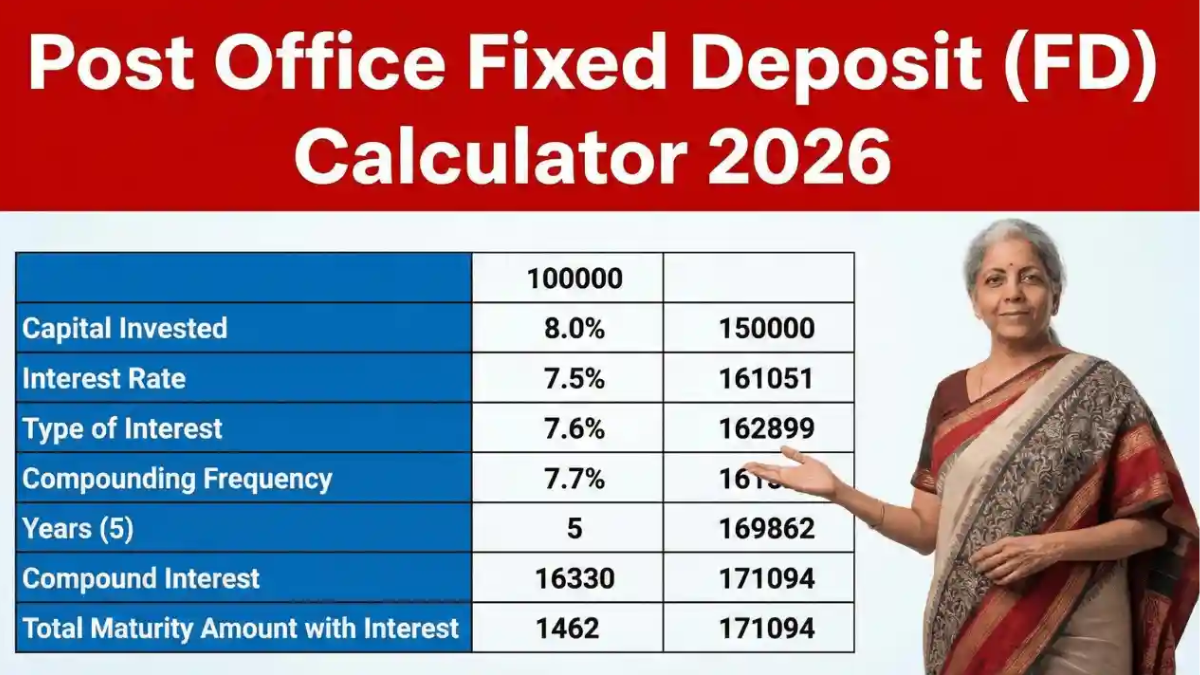

The maturity amount shown by the Post Office FD Calculator 2026 is calculated using quarterly compounding interest. This means interest is added to the principal every three months, resulting in better returns compared to simple interest.

Example Calculation:

Suppose an investor deposits ₹1,00,000 for 3 years.

The calculator will consider:

- Principal amount: ₹1,00,000

- Tenure: 3 years

- Applicable interest rate for 2026

- Quarterly compounding

Based on these inputs, the Post Office FD Calculator 2026 will generate:

- Total interest earned over 3 years

- Final maturity value payable at the end of the term

This transparent calculation helps investors understand how compounding impacts their savings and allows them to choose the most suitable tenure based on financial goals.

also Read: Finance

Benefits of Using a Calculator Before Investing

Using the Post Office FD Calculator 2026 before investing offers several advantages:

1. Accurate Financial Planning

The calculator provides precise estimates, helping investors align their savings with short-term and long-term goals.

2. Time-Saving

Instant results eliminate the need for manual calculations or branch visits.

3. Better Comparison

Investors can compare different FD tenures and deposit amounts to select the most profitable option.

4. Risk-Free Decision Making

Since Post Office FDs are government-backed, combining them with accurate calculations ensures safe and informed investing.

5. Ideal for Tax Planning

The 5-year Post Office FD qualifies for tax benefits under Section 80C, and the calculator helps assess post-tax returns.

Overall, the Post Office FD Calculator 2026 empowers investors to make smarter, more confident financial decisions.

Final Evaluation

In today’s fast-paced financial environment, planning investments without proper tools can lead to missed opportunities. The Post Office FD Calculator 2026 stands out as a reliable and essential tool for anyone considering Post Office Fixed Deposits.

From understanding applicable interest rates to estimating maturity amounts and comparing investment options, this calculator simplifies the entire process. It ensures transparency, accuracy, and convenience while maintaining the trust and security associated with Post Office savings schemes.

Whether you are a conservative investor, a senior citizen, or someone planning long-term savings, using the Post Office FD Calculator 2026 before investing can help you maximize returns and achieve financial stability with confidence.